TR: You also recently did a deal with 5NINES, how did that fit into your plans?

AS: 5NINES had a management contract with a large global systems integrator that we took on. We now operate facilities for that systems integrator in Canada, the US, the Nordics, UK and Ireland, Netherlands, and a couple of additional European countries. We do everything for them, including M&E projects, the IT change management environment, and facility management.

TR: What are you putting your resources toward today?

AS: Toward two or three locations. Our focus on the enterprise market continues: acquiring enterprise-class assets usually in markets that are somewhat constrained in terms of capacity. London, Frankfurt, Amsterdam, and Paris in particular, from a European standpoint. Then also in some of the key metros in the US: Chicago, Toronto, Atlanta, and Silicon Valley. Generally speaking, the focus there is as always on finding existing facilities where there is an enterprise tenant who essentially has more capacity than they therefore see a need for and we can conduct some kind of sale and leaseback transaction. That would make them a tenant in, ultimately, what will become a multitenant facility. As with all of these things, location is a key part of that commercial model.

TR: How actively are you looking for such opportunities?

AS: We generally have somewhere in the region of 15 to 20 active deals. The market is pretty fluid. Some organizations that go to market then decide that they want to kind of retrench, but then come back to the market a year later.

TR: What market trends are driving such organizations toward this option?

AS: I see organizations that maybe three or four years ago said that they were going to move to the cloud, but are now finding some of their cloud migrations are either taking much longer or are more expensive than they were expecting, or the environment might’ve changed from a regulatory perspective. And that is giving them pause to consider staying where they are. Even though we can see a ton of interest in the enterprise space to migrate to the cloud, there is still some doubt in terms of what enterprises really want to do with their portfolios.

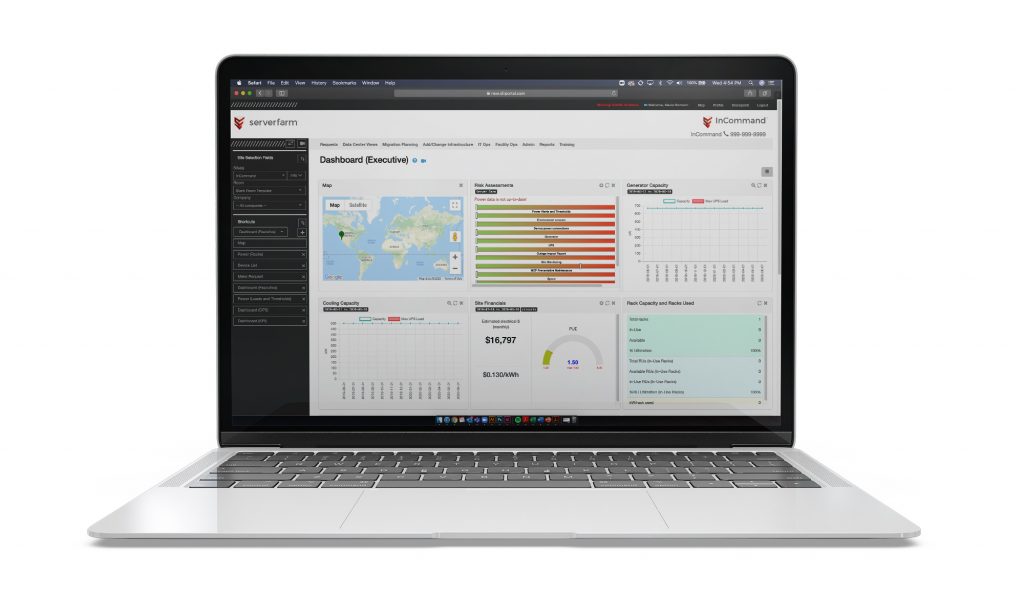

TR: How does your InCommand technology fit into your business model?

AS: Our entire operating model is based on technology, so one of the ways that we drive efficiencies where operating infrastructure is concerned is obviously through the use of technology. About 10 or so years ago, we started really trying to look at how to make our customers as efficient as possible. One thing that was and is very clear to us when we acquire sites is that most organizations are very good at using space, but not very good at using power. We really see two key reasons for that. One is they don’t have the right tools in place that would allow them to do capacity forecasting and demand planning so that they can deploy infrastructure in the most efficient way possible. As a result, they tend to run out of space much more quickly than they run out of power. Then the other part is process. In an enterprise organization, you will frequently have multiple parts of the organization making decisions about where capacity should be deployed, but there isn’t a single planning function and therefore there is a lack of ability to create efficiencies. So we developed our InCommand platform, which brings together all of the facility and IT physical infrastructure: real time information from building management systems, real time information from IT & FM environments, etc., into a central planning functioning where we make decisions about where and how infrastructure needs to be deployed and monitored. We use InCommand for everything from maintenance to asset management to ticketing to work order creation to capacity planning to demand forecasting, to reporting, to dashboards.